After the Freedom From Religion Foundation's historic victory against the clergy housing tax allowance, the judge's next move is eagerly awaited. U.S. District Judge Barbara B. Crabb, who in October ruled the clergy privilege unconstitutional, now must decide how to implement her ruling.

Crabb, seated in the Western District of Wisconsin, ruled in favor of a challenge by the Freedom From Religion Foundation of 26 U.S.C. § 107(2) of the tax code, saying it demonstrates "a preference for ministers over secular employees."

In a fascinating twist, both FFRF and the government are urging Crabb to nullify this provision, rather than extend the benefits to others.

That provision, enacted in 1954 to reward "ministers of the gospel" for carrying on "a courageous fight against [a godless and anti-religious world movement]," permits churches to pay ministers with a "housing allowance." The unique allowance is not a tax deduction but an exemption, allowing clergy to subtract major portions of their salaries from taxable income.

While ruling in FFRF's favor, Crabb left open the remedy, giving FFRF, the U.S. government and religious intervenors the opportunity to file supplemental briefs.

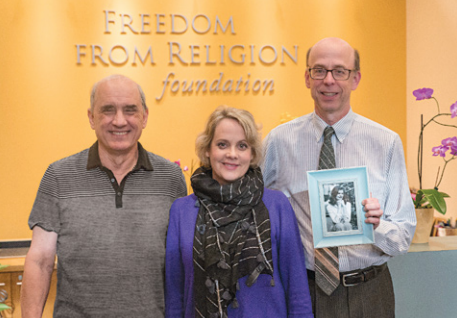

The options include an injunction requiring the IRS to extend the benefits to FFRF Co-Presidents Dan Barker and Annie Laurie Gaylor, who have been designated a housing allowance by FFRF, or to nullify the entire statute. The IRS has denied the pair a refund based on the housing allowance designated for them by FFRF. FFRF argues that allowing clergy this benefit while denying it to similarly situated heads of a nonreligious group is discriminatory.

FFRF is asking Crabb to prospectively nullify the statute, to order the IRS to refund the plaintiffs' housing allowance and to award plaintiffs legal costs. Nullifying the law would mean that Section 107(2) could no longer be used to provide favorable tax treatment to clergy and churches.

FFRF notes that the housing allowance "constitutes an exception to the general rule of taxation," therefore an extension "would have the effect of making the exception the general rule."

David A. Hubbert, acting assistant attorney general, points out that the clergy housing allowance already costs the government about $800 million annually. If the court were to extend the tax exemption to others, the effect would be to "create a tax expenditure of unknown amount." The government noted that if the court extended the allowance, it would need to define "which secular organizations would be eligible to provide such a benefit to its employees."

Where FFRF and the government disagree is whether Barker and Gaylor are entitled to a retroactive refund.

Interestingly, the government indicated it is "still considering whether to appeal the court's final judgment in this case." The government asks to stay all relief pending appeal, which FFRF does not object to. However, FFRF opposes the government's request to stay the court's judgment for a whopping 180 days after the final resolution of all appeals.

Needless to say, FFRF opposes the religious intervenor's request to remand the case to the IRS to give "the IRS or Congress an opportunity to the court's ruling."

This is FFRF's second time in front of Crabb over this particular inequity in the tax code. Crabb ruled in FFRF's favor in 2014, creating near hysteria by the clerical press. The 7th U.S. Circuit Court of Appeals, however, ruled that Gaylor and Barker lacked standing to sue because they had failed to apply for a refund.

Accordingly, the couple, who are married, applied for a refund and went back to court after being denied one by the IRS. Also a plaintiff is Ian Gaylor, representing the estate of Anne Nicol Gaylor, whose retirement as president emerita was in part designated by FFRF as a "housing allowance." She had requested a refund, but was denied it during her lifetime.

FFRF eagerly anticipates the judge's subsequent step.

The case is Gaylor vs. Mnuchin, 16-cv-215-bbc. FFRF is represented by attorney Richard L. Bolton.